Pre-Trading Expenses: What UK Businesses Need to Know

- mlyubenov

- Dec 23, 2023

- 3 min read

Starting a business often involves expenses even before you officially open your doors. Whether it's purchasing equipment, paying for market research, or getting initial stock, these costs incurred before you start trading are known as pre-trading expenses. In this article, we’ll explore what counts as a pre-trading expense, how they differ from other business costs, and the rules and practical steps for accounting for these expenses in the UK. This guide is designed to help both sole traders and limited companies make the most of their pre-trading investments.

Understanding Pre-Trading Expenses

What Exactly Are Pre-Trading Expenses?

In the business world, pre-trading expenses are the costs you incur before your business officially says, "We're open!" They can include expenditure for equipment like computers and software, vehicles, office furniture; necessary costs for website, marketing materials, basic office supplies and way more.

The main point is that pre-trading expenses are often tax-deductible. HMRC allows you to claim these expenses against your business's income, potentially reducing your tax bill. It's like getting a retroactive discount on those initial purchases and investments.

For sole traders and limited companies alike, understanding and correctly accounting for these expenses can be a game-changer. It not only ensures you're compliant with UK tax laws but also optimises your financial strategy right from the start.

In our next section, we'll dive into the nitty-gritty of HMRC guidelines, timelines, and eligibility.

Rules and Regulations

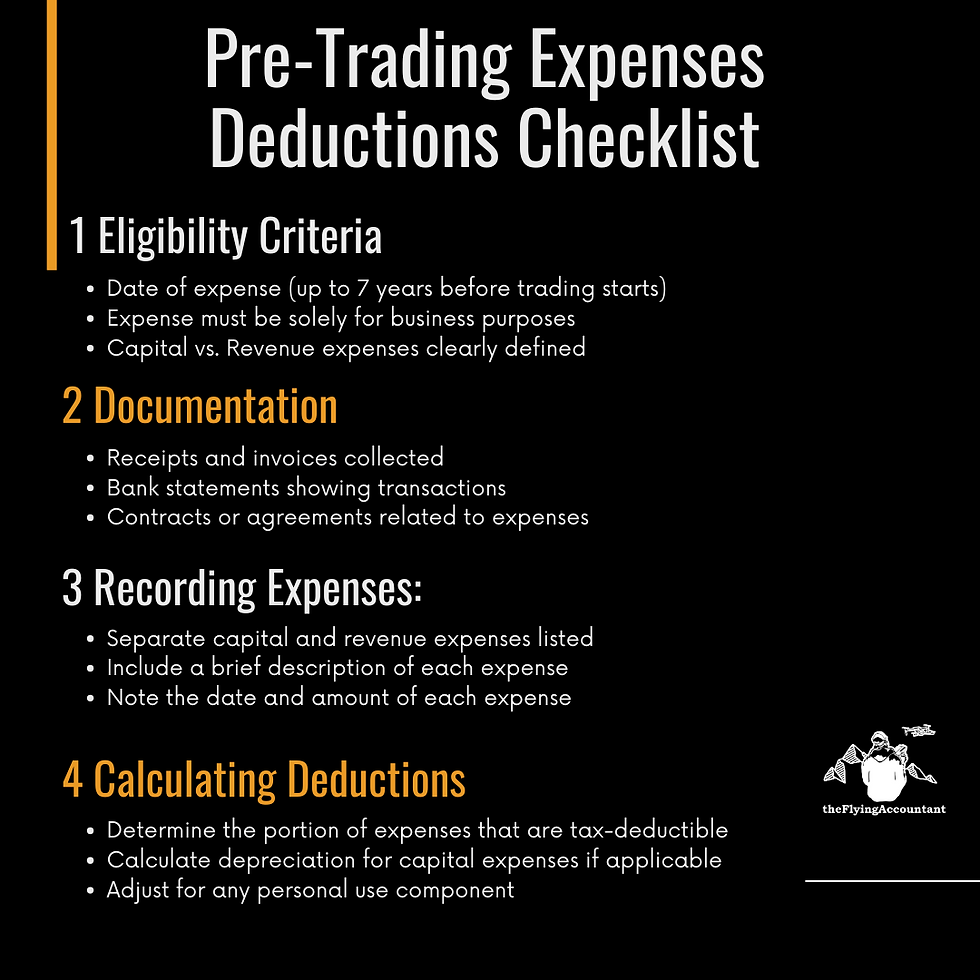

Pre-trading expenses are treated as if they were incurred on the first day of trading. This means they can be included in your business accounts and tax returns as if they were day one expenses. There are 2 type of expenses that you would incur:

Capital Expenses: These are the big-ticket items you purchase to set up your business. Think computers, machinery, or company vans. Capital expenses are usually one-time purchases that benefit your business over several years.

Revenue Expenses: These are the day-to-day running costs of your business. Rent, utility bills, and the cost of stock fall into this category. They're the ongoing expenses that keep your business ticking over.

With regards to revenue expenses, HMRC allows you to go back up to seven years before your business starts trading. That means all business related expenses within the 7-year timeframe, can be treated as pre-trading expense and potentially deducted from your profits in your first year of trading, provided it’s an eligible expense! Eligible expenses should be wholly and exclusively for the purpose of the business.

Note that capital expenses are treated slightly different, so it will be wise to get in touch with us or another professional accountant before your deduct the entire cost of your laptop from your business profits.

More Complex Scenarios

Now that we've covered the fundamentals, let's delve into some trickier situations you might encounter:

Converting Personal Assets to Business Use: For items owned before they were used in the business, or those received as gifts, the market value (the expected selling price) should be recorded in the business accounts, instead of the purchase price that the asset was originally bought for.

Dealing with Assets Bought Overseas: Purchasing essential equipment or stock from abroad before you start trading can be tricky. These expenses are eligible, but you need to consider additional costs such as import duties and VAT. Also, exchange rate fluctuations can affect the cost.

Renovations and Improvements before Trading: If you're making improvements on your property before opening your business, these costs can be a bit complex. Structural improvements are often considered capital expenses and can be depreciated over time. However, minor renovations might be treated as revenue expenses, fully deductible in the year they're incurred.

Staff Training and Recruitment Costs: If you incur costs for training staff or recruiting team members before your business officially starts, these can be included as pre-trading expenses. However, it’s important to link these costs directly to the setup and future operation of your business.

Review any pre-trading expenses you may have overlooked. Ensure they're correctly categorised and accounted for in your business finances. This proactive approach can save you money and set a strong foundation for your business's future.

If you’re unsure how to treat your pre-trading expenses, it’s best to get in touch with a professional that can help you understand this complex area. If you want to learn more, visit our website for more information.

Mario

theFlyingAccountant

Comentários