What's Changing in 2024? Business & Tax Insights

- mlyubenov

- Dec 18, 2023

- 4 min read

Table of Contents:

Introduction

Welcome to 2024 – a pivotal year for businesses navigating new tax realities. This guide is your roadmap to understanding and leveraging these changes for your business’s growth. We’ll decode the latest in National Insurance Contributions and demystify Making Tax Digital (MTD), preparing you for this significant digital shift. Expect practical insights on maximising tax deductions and key deadline reminders to keep you on track. Designed to be straightforward and actionable, this guide is your ally in turning 2024's challenges into opportunities for your business.

Top Tax Changes for 2024: What You Need to Know

As we step into the new tax year, there are a few key changes you should be aware of, especially regarding National Insurance Contributions (NICs) and the transition to Making Tax Digital (MTD).

National Insurance Contributions: A Shift in Rates

Class 1 NICs:

From 6 January 2024, the rate for Class 1 NICs is set to change. For earnings between £12,570 and £50,270, the rate will be reduced from 12% to 10%. This is a welcome relief for many employees, putting a bit more back into their pockets. However, for earnings above £50,270, the rate will stay put at 2%.

Self-Employed NICs:

For the self-employed, there's some significant news too. From 6 April 2024, Class 2 NICs are being abolished for those with profits above £12,570. Additionally, Class 4 NICs will see a reduction in rates from 9% to 8% on profits between £12,570 and £50,270. The rate above this threshold remains at 2%. This change is likely to be a sigh of relief for many self-employed individuals, easing some of the financial burdens.

Making Tax Digital (MTD): A New Era of Tax Reporting

MTD represents a major shift in how tax reporting will be conducted. Initially planned for April 2024, the government has now extended the timeline, giving businesses and landlords more time to adapt.

From April 2026, self-employed individuals and landlords with an income over £50,000 will need to keep digital records and provide quarterly updates to HMRC through MTD-compatible software. This requirement extends to those with incomes between £30,000 and £50,000 from April 2027.

Impact on Sole Traders:

Mandatory Software Use: You'll need special software to manage your self-employed taxes. This means moving away from manual records and embracing digital bookkeeping.

Shorter Submission Times: The window for submitting your returns to HMRC will shrink from 10 months to just 1 month.

Increased Frequency: You'll need to submit tax information 5 times per year – four quarterly updates and one final declaration. The submission for income tax will resemble that of VAT.

Phased Introduction: While initially set for April 2024, this major shift will now start from April 2026.

This change aims to make tax management more efficient, accurate, and easier for both taxpayers and HMRC. However, it does mean getting used to new systems and potentially adjusting your current way of handling tax affairs.

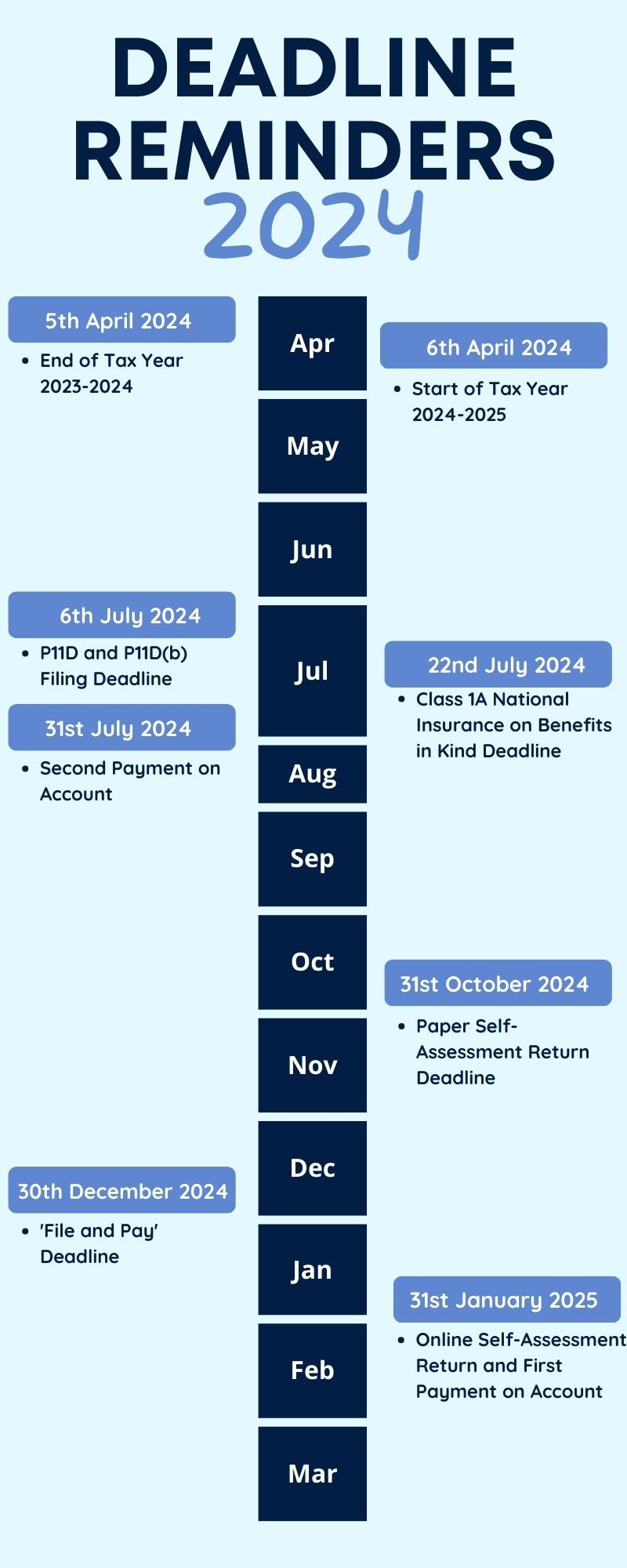

Deadline Reminders: Mark Your Calendar!

Whether you're a sole trader, a self-employed entrepreneur, or running a limited company, staying on top of tax deadlines is crucial. Missing these dates can be costly and stressful. Let's lock these dates in your calendar, ensuring you're well-prepared for the upcoming financial year.

Additional Key Dates for Limited Companies:

9 Months after Your Company’s Financial Year Ends - Corporation Tax Payment Due:

This is when your corporation tax bill is due. Each company’s deadline depends on its own accounting period.

12 Months after Your Company’s Financial Year Ends - File Company Accounts with Companies House:

Don’t forget to file your statutory accounts

Decoding Tax Jargon: A Layman's Glossary

Venturing into the world of taxes can feel like stepping into uncharted territory, where the language is as familiar as a foreign dialect. Let's decode some of these terms so they don't sound like riddles:

Understanding these terms can open up new avenues for tax efficiency and financial planning for your business. Now that we've decoded some of the more cryptic tax jargon, you’re better equipped to navigate the tax landscape with confidence!

Making the Most of Deductions: Don't Leave Money on the Table

When it comes to taxes, deductions are your best friend. They're like the hidden gems in the tax world, waiting to be discovered and put to good use. But often, they’re overlooked or misunderstood. So, let's shine a light on how you can make the most of these opportunities and keep more money in your business.

Identifying Your Opportunities:

1. Home Office Expenses:

· If you're working from home, part of your household expenses like heating, electricity, and internet could be deductible. It’s about getting a fair slice back for the part of your home that's become your office.

2. Travel and Entertainment:

· Business travel and client entertainment can add up, but they can also be deductible. Remember, it’s not just the big trips; even the mileage for local travel can count.

3. Equipment and Supplies:

· From computers to stationery, the cost of equipment and supplies needed for your business can be deducted. It's like getting a pat on the back for investing in your business operations.

4. Professional Fees:

· Legal, accounting, and other professional fees directly related to running your business are usually deductible. Consider it a nod to the necessity of expert advice.

5. Education and Training:

· Investing in your or your employees’ education and training can be a win-win, offering both skill enhancement and tax benefits.

Conclusion

As we come to the end of our journey through the maze of tax planning, it's clear that while taxes might never be the highlight of anyone's year, they don't have to be a source of dread either. With the right knowledge and preparation, you can turn this annual task into an opportunity to strengthen and grow your business.

Thank you for reading!

Mario,

theFlyingAccountant

Comments